1. Introduction

Economic activity in the countryside in general is

dominated by small-scale farms with the main actors of farmers, farm workers,

traders and agricultural inputs, agro-processing, and home industries. However,

businesses in general are still faced with the classic problem of the limited

availability of capital, capital constraints may limit the space for

agricultural activities in the rural sector (Hamid, 1986).

Weak capital owned by economic agents in rural

areas has been recognized by the government, with the state government launched

several programs for credit to farmers and small farmer entrepreneurs. Starting

with the credit Bimas on yeras 1972, then followed Credit Small Investment

(KIK) and the Permanent Working Capital Loans (KMKP), Income Generation Project

Farmer / Fisherman Small (P4K), Farmer Business Credit (KUT), and to date they

occurred People's Business Credit (KUR). Although the government has

implemented a variety of loan programs, but the performance results are deemed

still not in line with expectations. This is reflected in the performance of

financial institutions has not been satisfactory, especially on the financial

institution as the executor.

According Martowijoyo (2005) the weak performance

of financial institutions as financial intermidiasi institutions can be viewed

from three aspects: (1) low levels of loan repayment; (2) low morality of the

implementing agency, and (3) low level of mobilization of public funds. The

disadvantage of these has consequences for not continuing financial

institutions set up after the program is completed. As a result, program participants

generally will again experience a shortage of capital.

To answer the problem of limited capital and

banking institutions are difficult to access for small farmers, it is necessary

to further optimize the potential of financial institutions which can be an

alternative source of funding for farmers and rural communities. One of the

financial institutions that can be exploited and encouraged to finance micro

segment is Microfinance Institutions (LKMA), yet can not be used optimally.

LKMA built by the Government is able to exist and

contribute to serve the capital needs of low-income rural development although

in these institutions received government assistance. LKMA existence in the

countryside could play a role serving the needs of small farms, although it is

still limited in scope particular group. This shows their internal capital

mobilization in the communities of farmers / rural, so the issue of capital is

not always small farms can only be solved by relying on external capital

mobilization.

Subandi (2007) said the success of microfinance

institutions is influenced by several factors namely; (1) each institution

usually makes own concept of credit in accordance with the conditions in which

the institution is located, (2) the ability to foster a sense of family among

the member raises openness, and those who receive loans are truly in need, (3)

the belief, dogma and or a particular myth that states that the poor will have

difficulty in repaying the loan.

Fukuyama (2002) argues that social capital, focused

on the importance of the relationship in economic affairs. Furthermore it is

said that companies, industries, regional, and national economies can function

more efficiently if there is respect for one another and the relationship of

trust between citizens.

Putnam (1993), has also shown evidence that

economic growth is positively correlated with the presence of social capital.

Economic development in a community and economic development of rural would be

good if the following characteristics are owned by economic actors in a synergy

between the activities of the community, namely: (1) The presence of close

relationships in a village with other village between members people, (2) the

presence of leaders who are honest and egalitarian who treat themselves as part

of a community, not as rulers, and (3) the existence of mutual trust and

cooperation among the public.

Hayami and Kikuchi (1987) says that the norms and

principles of traditional facilitate the community to act collectively achieve

economic progress, and he also said that the villagers have been used to

regulate any economic activity by facilitating coordination in

the use of scarce resources through customs and institutions. Collective action

is a must for rural communities to provide for the needs / interests together

is both physical, such as, roads, irrigation systems, and others as well as

institutional, namely the rules and regulations.

In the study Nuwirman (1998) mentions the raising

of capital in the form of principal savings, mandatory, voluntary or sadaqoh

activity group bodies Kongsi and Barn Pitih (money) Nagari (LPN) in West

Sumatra.

People who have high social capital will open up

the possibility of resolving the complexity of the problems more easily. Mutual

trust, tolerance, and they can build networks of cooperation both within

community groups as well as with other community groups. Traditional

communities, are known to have informal associations were generally strong and

has the values, norms, and ethics collectively as a community interconnected.

Studies of Chaves and Gonzalez-Vega also revealed

that the Village Credit Institutions (LPD) Bali involving agents of the village

in their credit granting system is commonly called the techniques of credit

based on the characters. Further Chaves and Gozales-Vega said that lending

based on character and local control is efficient to avoid the possibility of a

loan was not returned.

Other institutions have been

successful in utilizing local institutional as financial intermediaries with

rural communities is a non-bank credit institutions such as LPD and Lumbung

Bali Pitih Nagari (LPN) in West Sumatra. The purpose of the institution is a

financial intermediary for the rural poor (Robinson, 2001).

LKMA models that exist in rural areas can be

differentiated into the individual financial intermediary (Individual Financial

Broker) and financial self-help groups (Financial Self-help Groups) (Korpp,

1989). IFIs in the form of individual financial intermediaries is very dominant

in the countryside (Wharton Jr., 1973; Gammel, 1994; Hayami and Ruttan, 1971)

and generally exploitative (Mubyarto, 1990; Ahmad, 1991). While IFIs in the

form of self-help groups (SHGs), although relatively less dominant (in the

restricted group), but are able to exist in serving the credit needs of small

medium businesses and not berifat exploitative, as Julo-Julo (Zakri, 2001) and

a group of joint venture (Nuwirman, 1988 ). The agency is able to meet the

credit needs of people who are not able to access credit sources Formal

Financial Institutions (LKF).

The ability of agencies played in the countryside

because he grew out of the community and has a joint capital (Acharya et al,

1992; Quinones Jr., 1992) based on the social values developed in the

community. Even in the group Kongsi in West Sumatra are social values, customs

and religion in financial management (Nuwirman, 1998). This is in accordance

with the lifestyle of the people Minagkabau "Indigenous Basandi Syarak

(ABS), Syarak Basandi Kitabullah (SBK). Based on the above phenomenon can be

formulated research problem as follows: a. Why Microfinance Institutions (LKMA)

can survive in the long term and play an effective role in serving the needs of

capital Small Farm (UTK) in rural areas?.. How Microfinance Institutions

implementing social capital in enhancing the role of microfinance institutions

to serve the needs of capital UTK. According to research problem as formulated

above, the purpose of this research is: Identify the factors that affect LKMA

can survive long-term presence and play an effective role in serving the needs

of capital UTK in the countryside and Explain how Microfinance Institutions can

utilize Social Capital element in improving the service to the UTK.

2. Review of

Literature

2.1 Financial Institutions

To understand the definition of financial

institutions clearly need to put forward some definitions by several experts,

including a financial institution as an institution that launched the exchange

of goods and services with the use of money or credit, help channel the savings

of people with excess funds to mesyarakat in need of funds. Then Seibel (1996)

more clearly defines financial institutions as an agency which collects funds,

give credit to the public or equity participation, as well as doing more than

one of the above activities as well.

In the money market commonly known as the two-term

formal and informal financial institutions, although between these two

institutions are the term semi-formal financial institutions (Seibel 1996;

Kropp, 1989). Formal and informal use of the term in the rural credit market is

widely used by researchers in various studies, but still a bit of literature

that suggests about formal and informal sense of the term.

In this regard, they emphasized the importance of a

simple legal aspects or their official government permission in the use of

formal and informal term for rural financial institutions. According to

Financial Institutions

Microfinance institutions

are program loans for small amounts to the poorest to finance the project he's

working on his own in order to generate income, allowing them to care for

themselves and their families, "Programmes extend small loans to very poor for cell-employment

projects that generate income , alowing them to care for Themselves and their

family ". Microfinance Institutions (MFIs) in Indonesia according to the

Asian Development Bank and the World Bank (Gunawan, 2007) The main

characteristic, namely; (1) provides a variety of financial services that are

relevant or appropriate to the real needs of the community, (2) serve

low-income communities and (3) using the procedures and mechanisms are

contextual and flexible to make it more easily accessible to poor people need.

Microfinance institutions have advantages that most

real, the procedure is simple, without collateral, to do that liquid (personal

relationship), and flexible loan repayment period (negotiable repayment).

Characteristics accords with the characteristics of the economic actors in

rural areas (especially in agriculture) which have limited assets, low levels

of education and income irregular cycles (depending on the harvest). Perdesaaan

characters like that are captured well by actors microfinance institutions, so

easily accepted by the existence of small communities. The main drawback of

microfinance institutions, yaknii still limited capital, making it less smooth

institutions meet the capital needs of members.

The presence of MFIs is needed for at least two

things (Pantoro, 2008). First, as one of the instruments in order to overcome

poverty. The poor generally have micro enterprises. Terminology World Bank,

they are referred to as economically active poor or micro entrepreneurs. In the

configuration of the Indonesian economy, over 90% of the business unit is a

micro-scale enterprises.

Developing micro enterprises is a strategic move

because it would realize the broad bases development or development through

equity. They need capital to develop its capacity. With business increases

(becomes small scale enterprises), will effectively address the poverty

suffered by themselves and expected to help people in the poor category.

2.2 Social Capital

Fukuyama (1995) illustrates the social capital in

the trust, believe and vertrauen means that the importance of trust is rooted

in cultural factors, such as ethics and morals. Trust appears the community to

share a set of moral values, as a way to create a common hope and honesty. He

also stated that the associations and the local network really has a positive

impact on economic welfare and local development and plays an important role in

environmental management. James S, Coleman (1999) asserts that, social capital

as a tool for understanding social action that combines theoretical

perspectives of sociology and economics. This notion was reinforced by

Serageldin (1999) that social capital always involves the community and make

the community arises not only from the interaction of market and economic

value. Serageldin provides a classification of social capital among others:

First, Social capital in the form of social interaction but durable

unidirectional relationship, such as teaching and social interaction trading

relationship was reciprocal (mutual) such as social networks and associations.

Second, social capital in the form of social interaction effects are more

durable in such unidirectional relationship of trust, respect and imitation are

in the form of a reciprocal relationship like gossip, reputation, pooling,

social roles and coordination, all of these contain high economic value.

Simple and general conclusion

that can be raised about the main elements of social capital include norms,

reciprocity, trust, and network, Fukuyama (1995). The fourth element is a

significant influence on the behavior of co-operation to achieve the desired

result, which could accommodate the interests of individuals and groups who

cooperate collectively. In real terms in everyday life, when examined in depth,

all the behavior of socio-economic activities of local community members

embedded in social relationships network.

Social capital and trust (trust) can create and

enable economic transactions become more efficient by providing the possibility

for the parties concerned to be able (1) to access more information, (2) allowing

them to mutually coordinate activities in the common interest, and ( 3) can

reduce or even eliminate opportunistic behavior through transactions that occur

repeatedly in the long span of time. Social capital is inherently contain a

social sense. Almost all forms of social capital are formed and grow through a

mix or combination of actions of a few people.

Social

capital will be growing and growing when used together and instead will decline

or even a decrease in extinction and death if not used or institutionalized

together. Social capital can not be transferred fully automatically from

generation to generation like a genetic inheritance in terms of biology.

Referring to Fukuyana (1995) there are three parameters ie social capital:

a. Confidence (trust): As explained Fukuyama

(1995), trust is a growing expectation in a society demonstrated their honest

behavior, organized and co-operation based on the norms that are shared. Social

trust is an application to this understanding. Cox (1995) later noted that in

communities that have a high confidence level, the social rules tend to be

positive, relationships are also collaborative. Social trust is basically a

product of good social capital, the social capital that is well characterized

by the existence of social institutions are solid, social capital gave birth to

a harmonious society (Putnam, 1995). Damage social capital will lead to

anti-social behavior (Cox, 1995), the absence of social capital in financial

institutions will lead to customer relationship with the manager of the

institution will not trust each other.

b Norma. The norms consist of understandings,

values, expectations and goals which are believed and run together of

religious, moral guidelines, and standards seem secular ethical code

propfesional. The norms are built and thrive based on the history of

cooperation in the past and applied to support the climate of cooperation

(Putnam, 1993, Fukuyama 1995). The norms can be a precondition nor a product of

social trust.

c. Network. Lenggono (2004)

explain the meaning of the network refers to the social relationships that

regular, consistent and long lasting, this relationship not only involves two

individuals, but many individuals. Relations between vindividu will form a

social network as well as reflecting the social groupings in community life.

Dynamic infrastructure of social

capital networks tangible cooperation among humans (Putnam, 1993). These

networks facilitate communication and interaction, allowing the growth of trust

and strengthen cooperation. Healthy communities tend to have social networks

that are sturdy, they then build a strong interrelationship both formal and

informal (Onyc, 1996). Putnam (1995) argues that social networks will strongly

reinforce the feeling of cooperation among its members as well as the benefits

from that participation.

2.3 Role of Social Capital

In the view of economics, capital

is everything that can benefit or yield, capital itself can be divided into (1)

capital berbetuk material like money, buildings or goods; (2) the cultural

capital in the form of educational quality; cultural wisdom; and (3) social

capital in the form of togetherness, social obligations that were

institutionalized in the form of common life, role, authority, responsibility,

reward systems and other attachments that generate collective action.

Coleman (1988), social capital is inherent in the

structure of relationships between individuals. The structure of social

relations form a network that creates a wide range of social qualities such as

trust, open, unified norms, and define the various types of sanctions for its

members. Putnam (1995) defines social capital as "features of social

organization such as networks, norms, and social trust that Facilitate

coordination and cooperation for mutual benefit".

Social capital is the adhesive for each individual,

in the form of norms, trust and networks, resulting in mutually beneficial

cooperation to achieve common goals. Social capital is also understood as

knowledge and understanding shared by the community, as well as patterns of

relationship that allows a group of individuals perform a productive activity.

Sajalan also with what is proposed World Bank (1999), social capital is defined

to the institutional dimension, relationship created, norms that shape the

quality and quantity of social relations in society. Social capital did not

mean only a limited number of institutions and social groups that support them,

but also the adhesive (social glue) that maintain the unity of the group as a

whole.

Lesser (2000), social capital is

very important for the community because it (1) provide ease of access to

information for members of the community; (2) into a media power sharing or

division of power in the community; (3) to develop solidarity; (4) allows the

mobilization of community resources; (5) allows the achievement of joint; and

(6) establish and organize a community kebersamaam behavior. Social capital is

a commitment of each individual to open with each other, mutual trust,

authority for any person who chooses to act according to its responsibilities.

This tool generates a sense of togetherness, solidarity and responsibility at

the same time will progress together.

Togetherness, solidarity,

tolerance, spirit of collaboration, the ability to empathize, the social

capital inherent in social life. The loss of social capital can be assured the

unity of the community, state and nation will be threatened, or at least the

collective problems will be difficult to resolve. Togetherness can ease the

burden, share thoughts, so you can bet the stronger the social capital, the

higher the resilience, fighting spirit, and quality of life of a community. In

the absence of social capital, people easily intervened even destroyed by

outsiders

Specifically World Bank (1998) provided a focus of

attention in the assessment of the role and implementation of social capital

and the possible contribution in the process of poverty reduction, especially

in developing countries. The role and position of social capital in the

community daily activities also have been studied more intensively by experts

from different scientific viewpoints among others, from the perspective of

agro-eco system, economics, sociology, politics, anthropology and psychology.

Experts have agreed that trust and social capital

of Understanding that social capital has the ability to contribute

significantly to the process of social and economic development of society has

become more prevalent. This is in line with the views Georgi (2003) which

basically concludes that social capital includes individual talents, the

accumulated knowledge of society, and society's forms of interaction,

organization and culture can make a significant contribution to economic growth

and development of society.

3. Results and Discussion

3.1. Role

of Financial Institutions on Financing Small Farmers

The results of the analysis of the role of LKMA

found that LKMA Panampuang have alignments and is capable of meeting the needs

of credit UTK. But still there are problems that the limited amount of funds

that can be given to members. This is due, among others, the poor ability of

members to raise capital collectively. In addition, the contribution of loans

to the increase in revenue (yield) members are still relatively low, because

there is still borrowed funds used for the benefit of family / consumer and the

limited number of credits earned.

The conclusion of this analysis of empirical

findings on facts on the ground by analyzing the five aspects above the LKMA

Panampuang).

a) Establishment of the Institute of Philosophy. LKMA

Panampuang (Panampuang= name of place) was founded in 1996 by the Government of

Agam as a response to the failure of IDT program and KUT in some jorong in

Kenagarian Panampuang, especially in villages Panampuang. Although initiated by

the government, but with determination, the spirit of togetherness and support

of all citizens, especially public figures such as village chiefs, traditional

leaders, religious leaders, and youth, however, the organization may be formed

in accordance with the government's desire. Purpose of establishing the

institutions to improve the local economy is relatively weak, by providing

credit.

LKMA Panampuang Prima established by the government

in 2008 by the Government of Agam. The establishment of the program is

motivated by the failure of previous Bangdes so the acclaim and the support of

community members such as village heads, religious leaders. and the youth. With

his determination and spirit for the common good ultimately these institutions

can be formed in accordance with the government's desire.

In accordance with the economic conditions at that

time were relatively weak and many people trapped practice of moneylenders, the

institution established to improve the local economy by providing credit for

venture capital, with the hopes of the people no longer borrow credit from

moneylenders.

In carrying out its activities as a source of

capital in the countryside, this institution is able to realize the objectives

of the institution to meet the capital requirements UTK. This is supported by

the application procedures and requirements easily and without collateral in

credit services. Although the agency established by the government, but were able

to show partiality to the UTK.

b)

Accessibility.

LKMA Panampuang is a financial institution that was introduced by the

government but managed by members of the community, so that in carrying out its

activities depends on the participation of members. As a savings and loan

institutions, these institutions are still implementing procedures and

administrative requirements as other financial institutions, but relatively

simple. To get a loan, members must be registered as an active member, has a

decent effort to be financed, and fill out a form of borrowing.

Procedure to be followed is fill out a form of

borrowing, then the board will check the business to be financed. When owned

businesses there and in accordance with the funds raised, the board approved

and the funds can be disbursed. Requirements and procedures easily provide ease

of access, especially small farmers.

The location is very close to the institution

housing residents. Panampuang LKMA office has its own building and located in

the middle of human settlements Panampuang villages, districts Ampek Angkek

Agam district. Thus a very strategic location because it lies between the

residential area, it is very easy to reach by foot or rural transport and

motorcycle taxis.

Credit application process until

the credit disbursed relatively short. In LKMA Panampuang only 2-3 days, this

is possible because the first location is ditengan residential institutions and

between institutions and the board members know each other.

Determination of collateral

requirements on LKMA Panampuang only required for the loan is not more than Rp

5 million, turn over the collateral, however Borrower must have a viable

business. This requirement is only a formality to see the seriousness member

uses credit, even less so the board just ask the establishment, regardless of

the physical.

Credit refund system set by installments. In LKMA

Panampuang originally defined according the harvest, but many members objected,

finally converted into monthly installments. Each member is required to attend

the meeting, either wishing to borrow and pay the installments. For the smooth

return of credit, members of delinquent fines then 0.25 per cent per day of the

installment amount for one-time arrears.

Determination of credit repayment system at this

institution does not affect the level aksessibilitas members, but will affect

the level of loan repayment terms of the number of arrears is still relatively

low. only 0.5 percent of total loans.

The low percentage of arrears of members illustrate

that members feel has the institution as a source of venture capital.

Specifically indicate that farmers more easily meet the refund system for

retrieval system in accordance with members' expectations. Besides, the general

low level of arrears credit institutions Panampuang LKMA also be caused by the

following factors:

1)

Their

perception of the notion of an individual, that credit is a local government

assistance, which can help undercapitalized.

2)

The high

awareness of members paying the installments. This is evident from the low

percentage of delinquent members to pay credit.

3)

The

existence of mutual trust between members and administrators in developing

lemabaga (LKMA) for officers / officials have a good relationship with a member

of either family or friendship

relationships fellow citizens.

Based on the procedures and

administrative requirements, collateral requirements, as well as relatively

easy to reach location, the process of borrowing relatively short, and the loan

repayment system, it can be concluded that the source of credit from a

financial institution that can be easily accessed by members. It proved most

members can take advantage of the available credit, including farmers.

At LKMA Panampuang accsessibility

level of farmers to credit sources is quite high in 2012. Of the number of

active farmers in 2012 the number of members who can access credit in the agricultural

sector amounted to 30 members (68%), whereas 14 (32%) in the trade sector. This

condition illustrates that LKMA more aligned to farming than trade.

The composition

of loan recipients

based on the

type of work

on both LKMA can

be seen in

Table 3.1.

Table 3.1. Number of Receivers of Credit, by Type of Work At LKMA

From Table 3.1. The above also can be seen equity

attributable lending. In general, the two agencies have been distributing most

of the credit to small farmers. In LKMA Panampuang, enough credit loans

properly distributed to farmers. From all loan recipients, there were 68

percent of the farmers who received credit, 32 percent of merchants. LKMA means

Panampuang distribution of loans to small farmers has been quite good, without

any discrimination between farmers and traders.

This description indicates that

LKMA Panampuang in distributing loans to UTK in the countryside has been quite

good, and feel can help meet the capital to farm.

Table 3.2. Contributions Loans to Members User

Credit Income on LKMA Panampuang

d Role of Credit for Small Farms

In general, the two institutions

could play a role LKMA Panampuang capital requirements UTK. Padatahun 2012 from

all members active farmers are 68 percent of loan recipients. able to utilize

sources of credit. Quite a high percentage of the allocation of the loan,

indicating the existence of LKMA has benefited UTK in meeting the needs of

business capital.

While in increasing the members'

income as a result of the use of credit has not given the expected results. In

LKMA Panampuang of total farmers loan recipients, only 10 percent who use

credit for the benefit of productive and felt an increase in revenue, compared

to traders who are able to achieve 14.92 percent. The low contribution of the

loan to increase farmers' income, caused by the use of credit that are not

entirely for the sake of earning. Farmers are forced to use some of the funds

for the purposes of the family while waiting for the harvest.

From this description it can be

concluded that from the aspect of expediency of credit for small farmers in the

countryside, the institution only at the stage LKMA Panampuang meet only a

fraction of capital requirements UTK. While a role in increasing revenue, not yet

felt by farmers. Conditions such as these reflect the ineffectiveness LKMA as a

driver of agricultural development in the study area.

e role of the Board in the Capital Mobilization

In LKMA Panampuang,

administrators / managers selected through community meetings attended by the

clerk's office of rural development (PMD) as well as the village head, the head

of KAN, religious leaders and youth. Board selected through consultation with

the spirit of togetherness based on guidance from the clerk PMD. Board which is

chosen from the several elements of the society, with consideration of the

effectiveness of management of the institution. Board at the beginning was

formed consisting of the supervisory board, companion extension, board

committees, the chairman, secretary and treasurer plus 5 managers.

In LKMA Panampuang, officials drawn from village

residents Panampuang which consists of various elements of society. Board

selected through consultation with the spirit of togetherness based on

instructions from the clerk's office PMD, attended by the village head, the

head of KAN, religious leaders and the young man. Some administrators are

active at this time include Supervisory Board Chairman of the Manager,

Secretary, and Treasurer. Generally administrators / managers in both the

background of the financial institution to the top high school education, and

in the absence of selection but select appointed by consensus at a meeting of

members. But still equipped with management skills through special training by

the district at the beginning of the establishment of the institution. In LKMA

Panampuang Prima is an institution established by the government, so that the

authorized capital of these institutions came from the district government

through the department of agriculture and PNPM, but the board does not just

rely on these funds, but do collective capital formation through the members'

contributions in the form of deposits. Help initial capital of Agam received

government LKMA Panampuang In LKMA Panampuang shape and size of deposits was

decided involving the participation of members in management and members of

deliberation. Principal paid each member at the time of loan borrowing,

amounting to Rp 25.000, -. While deposits shall be paid on each monthly meeting

of Rp 5.000.-.

Besides fertilizing done through a capital loan

service payments by 1 percent and loans received. In LKMA Panampuang collective

contribution to capital formation in 2012 largely from the source of funds in

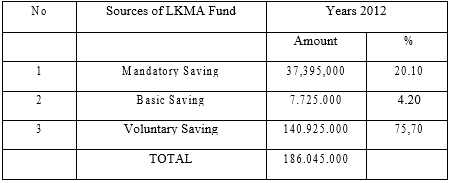

the form of compulsory savings, voluntary principal and Rp 186 045 000, - The

high contribution of compulsory savings and voluntary savings due to both an

obligation that must be met when receiving a loan, while the low contribution

of principal due to the relatively small amount of capital available to

members. While the low contribution of voluntary savings due to the relatively

small contribution of credit to the increase in revenue that can be set aside.

Sources of funds in capital mobilization collective Panampuang LKMA can be seen

in Table 3.3. following:

From the above it can be concluded that in addition

to the mobilization of external capital from the government, also found

internal capital mobilization of members. In the internal capital mobilization

role of the board and the members are very important, not only able to meet the

credit needs, but also to develop the independence of institutions, however

both lmbaga not maximized in raising capital sourced from internal collective.

3. 2

Personality and Dinamics of Small Farm Credit Services as Object.

From the

analysis of the nature and dynamics of farming on LKMA Panampuang, show that.

LKMA existence in the study area tend to be aimed at serving the needs of

capital UTK, especially for UTK who are denied access to formal financial

institutions. This is consistent with the nature and dynamics of farming organizations,

namely the object of credit services both agencies are small businesses with

total area of between 0.25 to 0.5 hectares.

Most farmers cultivate land belonging to other

people (tenants) with food crops (rice) and pulses, as well as using a credit

not only for farmers, but also to cover the costs of the family that are urgent

as is the case for financial institutions semi-formal, conditions such as it

became one of the causes of bad loans.

Although the number of credits earned relatively

limited, but to obtain farmers are not subject to collateral requirements. Most

farmers are very dependent on loans, but the procedure - terms and credit

pengembalan system is felt not so burdensome. This conclusion is supported by

the empirical findings of the analysis of the nature and dynamics of the

farming area of land, land status, type of plant, the intended use of the

credit, collateral, the amount of credit, capital resources, procedures and

requirements, and loan repayment system.

a) Land. The land area is cultivated by farmers from

both LKMA Panampuang Prima generally range between 0.25 -0.5 hectares. Based on

data collected in the field turns on LKMA Panampuang 85 percent of farmers have

land area between .25 to 0.5 hectares and 15 percent pursue an area of between

0.51 to 1.0 hectares. The area of land cultivated by the farmers credit

recipient, it can be said the majority of farmers are small farmers who are the

target of credit services in rural areas.

b)

Land

Status. Land tenure on the loan recipient farmers LKMA Prima Panampuang more

(80 percent) in the form of arable land or to manage other people's land, while

the rest (20 percent) the status of their own land.

c)

Type of

Business / Plants. Farmers who are members of both the credit receiver LKMA

Panampuang generally cultivate the land with food crops (rice and pulses),

which is seasonal. In LKMA Panampuang 70 percent of farmers cultivate their

land with food crops (rice), while the other 30 percent of land planted with

crops.

The variation of plant species this institution is

more influenced by the characteristics of the livelihoods of local people who

cultivate land crops (rice and Palawija).

d) Purpose of Use of Credit. In general purpose member

farmers apply for loans with the purpose to finance the farm. This is in

accordance with the conditions set by the board LKMA Panampuang But in the

field, farmers tend to avail loans to finance not only farming, but is also

used to fund family life such as school fees, the cost of child marriage. This

is caused by the lack of selection of beneficiaries tight credit, weak

supervision of the board after the credit disbursed, and their family needs are

very urgent.

In LKMA Panampuang only 76.5 percent of the farmers

who use loans to finance farming. While 23.5 percent of other farmers loans

used to finance not only farming but also to finance the needs of family life,

such as consumption and children's school fees.

e)

Collateral.

Generally members do not have collateral. Thus, in applying for loans of credit

to LKMA Panampuang for a loan as a member is not required to submit collateral.

In this case the credit lending is based more on trust. However, to obtain a

loan must have a member of the land / business eligible to be financed by the

agency, which is a formality that the loaned funds are intended to finance the

farm.

f) Capital Resources. In LKMA institutions Panampuang

limited capital is a constraint faced by all members of the farmers, so that

the loan is a major source of capital. Farmers do not have their own capital to

finance the schemes, farmers are very dependent on loans from the institution.

Lack of institutional capital is not all the expectations of farmers / members

can be met, so as to obtain a loan teraksa members until one month.

g)

Procedures

and Requirements for Credit. In all farmers get loans to institutions (LKMA

Panampuang) meets. Procedures and credit requirements that must be met

relatively simple and easy to fulfill. Farmers only apply to the management of

credit by filling out the form requirements, have a viable business, and

registered as a member.

In LKMA Panampuang within 2 to 7 days of credit is

received by the farmer. From interviews with farmers, all farmers feel the

procedures and requirements set board is relatively simple and easy to fulfill,

but with the limited amount of funding exists on both institutions led to the

loan amount is very limited, it is causing the benefits of these loans have not

been up to the capital small farms.

h) Credit Refund System. In LKMA Panampuang credit

refund system is felt by all the farmers are relatively not burdensome. At the

beginning of the establishment of a credit Panampuang LKMA can be paid in

installments every harvest time or in installments over 4 times in the credit

period (10-12 months), but because some members objected credit eventually be

repaid each month. When farmers are delinquent fines amounting to 0.25% of the

loan. Although farmers do not get into trouble paying back the loans, but due

to failed harvests cause farmers in arrears up to 0.5 percent of borrowers but

still categorized institutions in healthy status (<5 percent). When farmers

are in arrears, the board only take action first to give warning verbally, if

not successful, the management brought the issue of arrears to the steering committee (committee) in which there are elements of

village government, ninik mamak, and the scholars so that arrears could

diselasaikan relative.

i)

Total

Loans. In Panampuang LKMA credit institutions is a source of major capital

obtained by farmers and the procedure is easy and straightforward. However, the

loan amount ranging from $ 500 thousand up to Rp 20 million and is highly

dependent in its ability to provide funding.

Number of farmers' needs in this institution

exceeds the capacity of financial institutions in providing funds, the

relatively limited amount of funds available in the two institutions because of

this limitation collective capital accumulation. The limited amount of capital

provided by the agency to make the customer of the institution is forced to

wait their turn until two months of the petition submitted to the board.

3.3 The

Role of Social Capital on the Effectiveness of Financial Institutions

From the analysis of the data shows that in LKMA

found only values the role of social capital in several aspects analyzed. In

LKMA religious values and traditional values are found in the implementation of

the activities of this institution. With the role of religious values and

customs on both LKMA shown that in recruiting prospective members / new borrowers, the board

always involves a longtime member (fixed) in deciding whether the loan will be

disbursed or not.

In terms of monitoring and evaluation functions

permanent members are also involved whether in terms of tackling while members

are in arrears to pay the loan (jointly and severally), then in terms of

religion has also been involved in motivating members of the clergy to be

obedient and responsible for obligations that should be paid. While traditional

values are also seen to involve the mamak ninik both in the lending process as

well as in the framework of evaluation and monitoring, including the settlement

of bad debts.

In LKMA Panampuang values of social capital in the

form of shared values, participation, trust, and financial contribution was

instrumental in the founding of the institution, the selection committee and

the management of institutions, capital formation, the credit lending process,

as well as monitoring and evaluation. This is reflected in the structure of the

board, where there is one part of the steering committee.

The steering committee is working to provide

direction to the board, especially in developing the institution, but it also

serves to resolve the arrears payments of members. Committees involved in

village government officials, department of agriculture, ninik mamak, and

scholars.

a)

Establishment

Process Institute. LKMA Panampuang founded in 1996 by the Government of Agam.

The Institute is one of the government programs as well as a response from the

district to the failure of IDT program and KUT in some jorong in Nagari

Panampuang. Although the formation was initiated by the government, but with

determination and a spirit of togetherness and support of all members of

society Panampuang especially public figures such as village chiefs,

traditional leaders, religious leaders, and youth, institutions can be formed

in accordance with the government's desire. Purpose of establishing the

institutions to improve the local economy is relatively weak, by providing

credit.

When linked to the values of social capital, in the

establishment of this institute initiated by the government in order to improve

the livelihoods of farmers as a form of spur agricultural development in rural

areas. When viewed from the establishment of this institution not include local

agencies, as established by the government, but in its operation handed over to

the local community. Although copper is formed with the concepts and

institutional system was introduced the government, but the process of

realizing the institution also depends on the support and determination of

citizens not only farmers, but also by the community leaders / religious,

village, density of indigenous villages (KAN).

Strong determination underlying spirit of unity,

cooperation and collective agreements establish the economic organization of

society for the common interest. The spirit of togetherness is reflected in the

form of a real participation of citizens attending meetings in mosques, offices

and agencies village hall. The role of public participation is manifested in

his involvement in any decision-making.

Management of savings and loan institutions

operationally is the duty and responsibility of the board and supervised by an

advisor, protector and overseer. Similarly, in determining policy and making

decisions regarding the rights and obligations of members conducted by the

officials and members were excluded.

The rights and obligations of members include (1)

shall form farmer groups of at least the 10 (ten) people, (2) shall attend the

meeting of the members of each month, (3) shall participate in capital

formation in the form of compulsory savings, principal savings, voluntary

savings and loan services, (4) is obliged to return the loan in installments

every month, (5) entitled to apply for and obtain a loan for considered

feasible by the board.

b) Finalization of the Board and Management of the

Institute. In LKMA Panampuang Prima, in accordance with the wishes of the

government, officials from among their Panampuang Nagari which consists of

various elements of society. Selection committee held at the head of the

village through community meetings attended by officials from the office PNPM

and the head of the ellipse, KAN chairman, religious leaders and youth, through

consultation with the spirit of togetherness.

Board which is chosen from the elements of society

and provided training in the management of savings and loans by the government

through the Agam district PNPM program. Board consists of 2 Advisory Board,

Trustee Protector Jorong and 3 Supervisors and Administrators who gterdiri

Chairman, Wail Chairman, Secretary, Deputy Secretary, and Treasurer.

When linked to the values of social capital, the

role of shared values and the participation of members only in the board

election process. Board selected through village meetings in the spirit of

togetherness, cooperation and mutual agreement. Board elected a form of trust

board member with the hope can bring members to a better life.

While in the management of the institution both

operationally and in determining any decision is the duty and responsibility of

the board without involving the participation of members. The role of member

participation only reflected in his involvement in the consultation meetings

both attendance and participation in decision-making regarding the selection

board.

c)

Capital

Formation. Capital formation, the role of social capital values are common to

both Semi-formal financial institutions. In LKMA Panampuang values of social

capital in the form of shared values, member participation, trust, and

financial contribution. While on KSPP Lundang only in the form of shared

values, beliefs, and financial contributions.

LKMA Panampuang is an institution established by

the government in which each of the funding must go through LKMA Puad, so that

the authorized capital of these institutions comes from government assistance

aimed at helping meet the needs of capital farmer groups with a membership of

266 people with the amount of wealth at the end of 2012 amounted to USD 551 394

293 , - capital this institution comes from government aid coupled with

principal savings, mandatory simapanan and time deposits, as well as the

efforts of capital formation through the members' contributions in the form of

deposits.

The shape and size of deposits was decided to

involve the participation of members in the board deliberations and members of

the RAT. Besides fertilizing done through a capital loan service payments

amounting to 1 percent of the loans received.

When linked to the value of social capital in

capital formation, it appears that the formation of collective capital

resources on LKMA Panampuang guided by shared values, participation and trust

and every member. This is reflected by their determination, spirit, and

cooperation to establish a joint capital resources.

Determination and spirit is applied in the form of

real action that is the willingness of each member placing funds in savings and

time deposits and a portion of net income (25 percent) retained as additional

capital based on trust and a sense of community among members and pegurus. In

addition, the board involve the participation of members in deciding the amount

of savings and loan services.

In the implementation of collective capital

formation have demonstrated their shared values in the form of a spirit of

togetherness, trust in management, and financial contributions of members of

the institution. The spirit of togetherness reflected by mutual agreement and

cooperation of members to provide a source of capital together. The willingness

of these members also indicate the existence of a trust value to board members

as well as financial contributions, in the form of principal savings, simwapin

and loan services.

d)

Loan Loan

Process. In the process of credit lending, the values of social capital is

relatively bigger role in LKMA Panampuang encountered. In LKMA, the values of

the social capital in the form of shared values, member participation, trust,

and financial contributions.

The process of credit lending in LKMA Panampuang a

collective agreement and board members. Although it is a credit service

operations carried out by the board, but the rules of procedure and the

requirements a joint decision involving members through member meetings and

board meetings. Thus the members had no difficulty because the process is very

simple and easy. Members who want to borrow loans just fill out the form and

submitted to the board / officer. Members are not required to provide

collateral and if the business owned by a decent, credit can be availed.

When linked to the values of social capital, then

there is a role shared values, member participation and confidence in the

process of credit lending. The role of common values reflected in the spirit of

togetherness and cooperation in determining the procedure and terms of

borrowing. The provision is a joint decision is discussed in the meeting of

members. Participation of members materialized in the form of the willingness

of members present at the meeting and was directly involved in formulating and

issue a decision. While the role of trust is reflected in the absence of

collateral requirements for members who borrow loans This is to educate members

in trying to be honest.

e) Monitoring and Evaluation. In the monitoring and

evaluation activities, the role of social capital values found in the

institution (LKMA Panampuang) in the form of shared values and member

participation. In LKMA Panampuang, monitoring and evaluation carried out by the

regulatory body are appointed jointly by the board and members.

The regulatory body is basically

just tasked with monitoring and evaluating the implementation of the activities

particularly the management of funds by the board. Besides, monitoring and

evaluation in general is also done by the members through a RAT. Monitoring is

done is about the course of events over the past year and plan activities for

the next year, while the evaluation is about financial accountability by the

board. While monitoring and evaluation of the administrative accounting and

reporting by the supervisor.

When linked to the values of

social capital, in LKMA Panampuang there are shared values and the

participation of members that play a role in monitoring and evaluation. Shared

values that play a role is in the form of a spirit of togetherness and

cooperation for the mutual benefit to oversight. Although the monitoring is

done by the regulatory body, but every problem can not be separated from

monitoring or supervision and contribution of some members.

The role of member participation is evident from

the willingness of members attending each meeting. Each member is required to

attend the meeting to discuss and find solutions to the problems facing the

institution. The role of social capital in LKMA shown in Table 3.4.

Table 3.4. Role of Social Capital in the

Institution

| ||

a) Regulatory Aspects. Although LKMA development

program is part of the county government, but the agency has no legal basis and

operational in carrying out its activities. The only operational base is AD /

ART created by governments and society.

b)

Aspect

Capital Assistance. To support the operations of the institution LKMA never

received capital assistance from the district administration at the time of

establishment of the institution. In an effort to boost the economy of poor

rural communities through the provision of capital by the government. LKMA

obtain financial aid from the government amounting to Rp 100 million as initial

capital Agam operational agencies in 2008. The initial capital is first used as

loans to members.

Help initial capital received by

LKMA a positive impact on the provision of loans to its members. However, recently

the number of members feel the credit is inadequate because of the limited

availability of capital. The provision of capital amounting to Rp. 100.000.000,

- financially can not mengmbangkan effort by farmers. This assistance is more

prominent than the political elements of the economic element.

c)

Aspects

of Development. From the aspect of coaching support, obtain guidance from the

government in the form of training. The board LKMA provided training in the

management of financial institutions held by the government of Agam district at

the time of establishment of the institution. The training aims to provide the knowledge

and skills regarding the management of the institution, especially regarding

credit services to members. Therefore, a program of the government agency, then

this training is very useful for administrators in managing the institution.

4.

Conclusion

Based on the results of research and analysis, we

can conclude that there are three important factors that cause LKMA can survive and play an effective role in a

rural airport FOR namely:

1). Elements of Faith. The nature of trust between

members with members and between members of the board resulted in the formation

of a network that enables the formation of mutually beneficial cooperation

between members in achieving common goals. These conditions affect the

suitability of the characteristics of the institution with the characteristics

of the nature and dynamics of UTK, this condition causes LKMA easily accessible

by UTK. Characteristics of institutions characterized by UTK as the main target

of credit services, procedures and administrative requirements are relatively

simple, does not require collateral, repayment system is relatively lightweight

and flexible, and easy to reach location. While the nature and dynamics of UTK

is characterized by a limited area, there are still peasants, and the business

is seasonal. While the dynamics of UTK include reliance on credit loans, no

collateral, and just being able to access credit that do not bloom / low

interest rate and easy to obtain.

Ease of access of farmers to financial institutions

causing farmers to succeed in the implementation of agricultural activities.

Such a condition indicates that the character of financial institutions in

accordance with the characteristics of farmers, led to the development of

agriculture and increase farmers kesejahreraan better. Mutual trust between the

manager and members by making mutually beneficial working system between

managers and members. Mutual benefit will arise if the results of the

activities carried out benefit the two sides. This situation will lead to

mutual trust, sympathy, mutual participation and sense of belonging to the

institution. This was evident at LKMAPanampuang Prima, effectively serving the

needs of capital.

2)

Network

Elements. Empirical facts stated that credits earned UTK mainly benefit the

credit needs to sustain its agricultural business capital. This situation as a

result of involvement of financial institutions to serve the needs of capital

for UTK are our customers. The success in the management of the institution has

LKMA main source of capital (initial capital payment and savings), so as to

empower UTK in fulfilling the capital although still DSLAM limited quantities

without relying on external capital mobilization, especially from the

government.

3). Elements Norma. From the aspect of the rules /

policy of the government, the upfront analysis showed that LKMA after being

given initial capital, as it does not have a dependency on the government, so

it is able to exist and contribute to UTK. This condition is seen on the level

of compliance with the provisions, the rules they created together. This

indication is reflected in the low tingakat loans (2%).

5.

Suggestions

Sisitem Operating Procedure (SOP) is formulated

based on an element of trust that has been shown to create an independent local

agencies and beneficial in meeting the capital of the farmers. To mengarangi

operating costs, the establishment of a network system also proved to make the

system more effective cooperation and norms / rules are made jointly make the

members abide by the rules according to the agreement, it also makes a

collective capital formation was effective.

Therefore, it is suggested that microfinance can be

entrusted management / delivered to local bodies under the supervision of their

pemerintrah brackish areas. Specific regulations on microfinance / informal

financial institutions such as LKMA can be set by local governments either

provincial or local government or city government, as has been done in the Barn

Pitih Nagari (LPN) West Sumatra Governor governed by district head of West

Sumatra province in 1976.

References:

Acharya. M, Shrestha.B, and

Seibel.H.D. 1992 Self Help Groups in Nepal, in the Self Help as informal

intermediaries. B.R. Quinones Jr.Ed. 1992. Bangkok, Thailand: APRACA

Publication.

Muchtar Ahmad et al, 1991 Institutional Agriculture

and Poverty in Riau, Riau Pergepi Commissariat.

BPS, 2012, the Human Development Index 2009-2010, Jakata: BPS.

Cernea, M.M. 1993, The Sociologik's Approach to Sustainable Development.

Finacial & Development, December 11 to 13

Coleman, J. 1988. Social Capital

in the Creation of Human Capital. American Journal of Sociology 94: S05-S120.

Cox, Eva. 1995. A. troly Civil Society, Sydney: ABC Book.

Dasgupta, P. and Ismail Serageldin, eds., 1999. Social Capital: A

Multifaceted Perspective. Washington DC:

World Bank.

Dhesi,

U.S., 2000, Social Capital a Fukuyama, F. 1995. Trust: The Social Virtues and

the Creation of Prosperity.

New York: Free Press.

Fukuyama,

F. 1995. Trust: The Social Virtues and the Creation of Prosperity. New York:

Free Press. Fukuyama, F. 1999. Social Capital and Civil Sociaty, Institute of

Public Policy, George Mason University. Fukuyama, F. 2002. Social Capital and

Civil Socciety. International Monetary Fund Working Paper, WP / 00/74

1-8 In Elinor Ostrom an T.K. Ahn. 2003 Foundation

of Socil Capital. Massachusetts: Edward Elgar Publising Limited

Gemmel, N, 1994, Science Development Economics; Multiple Survey Jakarta:

Pustaka LP3ES.

Georgi, B.P. 2003, The Role of

Human and Social Capital: Extending our Understanding, Department of Economic,

University of the Witwatersrand (unpublished paper). © Pages in Agro Economic

Journal Vol.11. 1 June 2004 (Page 77-86)

Hamid E.S..1986, Records of the

Seminar. In the Rural Credit in Indonesia. Mubyarto and Edy Suandi Hamid (Eds)

.Yogyakarta: BPFE.

Hayami,

Y. and Vernon W. Ruttan, 1971. Desequilibrium in World Agriculture Development

in Agriculture Development: An International Perspective, Baltimore and London:

The John Hopkins University Press.

Hayami, Y. and Masaro Kikuchi. 1987 Village Economic Dilemma. Jakarta:

Obor Indonesia Foundation.

Korpp, Erhard. Et al, 1989 Linking

Self-Help Groups and Banks in Developing Countries, APRACA GTZ, Eschborn.

Lenggono P.S 2004, Social Capital

In Pond Management, Case Study On Community Farmers in the Village of Muara

Pantuan, District Anggana, Kutai Regency (thesis), Bogor Agricultural

University Graduate School of Bogor.

Lesser, E., 2000, Knowledge and Social Capital: Foundation and

Application, Boston: Butterworth-Heinemann,

Martowijoyo, S., 2005. The Future

of Microfinance Institutions in Indonesia: Overview of Aspects of Regulation

and Control.

Narayan, 1997, the Voice of the Poor: Poverty and Social Capital in

Tanzania, World Bank,

Nuwirman,

1998, Role of Local Organizations In Survival Defend the Poor Rural Economy.

Padang: Thesis On Graduate University of Andalas.

Putnam, et.al., 1993, Making Democracy Work: Civic Traditions in Modern

Italy, Princeton

Putnam,

R., 1995. Bowling Alone: America's Declining Social Capital. Journal of

Democracy 6: 65-78.

Robinson, M.S., 2001 The Microfinance for the Poor, Revolution: Sustainable

Finance for the Poor, Washington,

D.C. .: The World Bank.

Sculler, T., 2001, The

Complementary Role of Human and Social Capital. Isuma Volume 2 No. 1. Spring /

Printemps ISSN: 1492-0611.

Seibel, H.D. 1996 Financial System Development and Microfinance Germany:

GTZ, Robdorf.

Subandi, S., 2007. Successes and Prospects of Grameen Bank Replication

Concepts For: Microcredit Institution.

Ministry of Cooperatives and SMEs.

Uphoff, N, 1999, Understanding Social Capital: leraning from the

Analysis and Experience

Wharton, Jr., C, R, 1973 The

Infrastructure for Agricultural Growth, in Agricultural Development and

Economic Growth (Herman M. Southworth and Bruc F. Johnston, Ed.). 1973, Perss

Corneli University, Ithaca and London. P.125-126.

World Bank, 2003. Social Capital. Download of http://www.world

bank.org/proverty/scapital.

Tidak ada komentar:

Posting Komentar